tax attorney vs cpa salary

Please kindly provide more information. Draft your articles of incorporation.

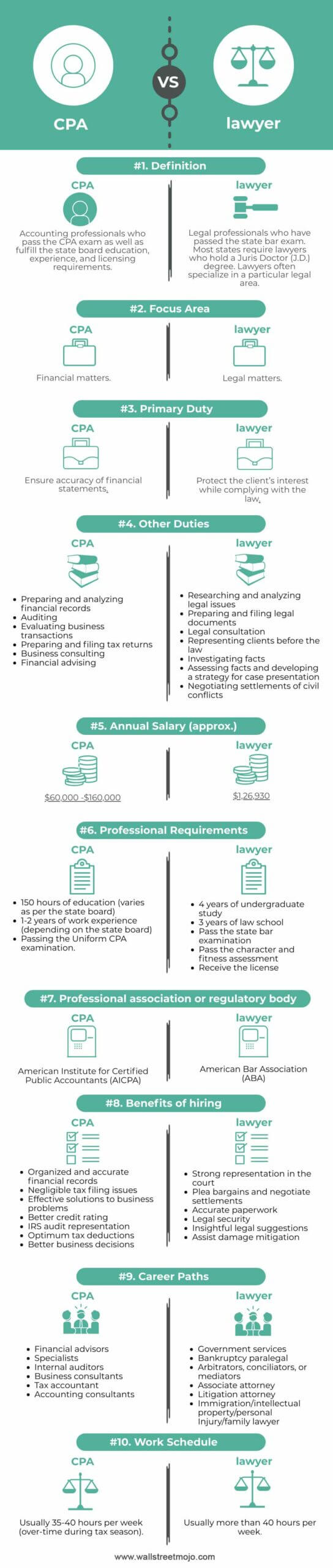

Cpa Vs Tax Attorney Top 10 Differences With Infographics

The tax rate for PSC earnings.

. January 6 2021 at 846 pm. 171103 Determination of Gross Receipts From Business Done in This State for Margin Accessed Nov. 8-2015 Catalog Number 21096G Department of the Treasury Internal Revenue Service wwwirsgov.

Ohio Laws and Rules. Texas Tax Code Sec. The SE tax on 60000 is 9180 and the income tax is 4865 for a total of 14045.

Hiring an attorney or CPA will cost between 1000 and 3000. Articles of incorporation are essentially your business birth certificate. Thats quite a bit lower than you would pay personally if you were receiving that same 50000 as salary.

If you choose to set up your LLC with just one spouse as a member you can classify it as a sole proprietorship or a. As the name suggests income tax expense only accounts for taxes related to income and not other assets like. Understand Tax Implications.

Some states require multiple filings so check to see what forms you need. Income taxes from your LLC are based on your personal salary and profit from the business. Commercial Activity Tax.

Their expertise is more than worth the cost. So to head off the anticipated revenue drain the IRS closed the loophole by designating C Corporations that provide services as PSCs. Joe is a self-employed writer and had 60000 in self employment income in 2020.

Tax Exempt and Government Entities EXEMPT ORGANIZATIONS Tax Guide for Churches Religious Organizations 501c3 Publication 1828 Rev. Congress has enacted special tax laws that apply to churches religious organizations and ministers in recognition of their. Bank account we recommend you speak with your bank.

Information in the articles of incorporation must include. I am more than happy to talk to someone in the office. He has to pay 153 self employment SE tax plus income tax based on his individual tax rate.

I was wondering if I can still get monthly salary to my existing US Bank account and what do I need to do for personal income taxes. Income tax expense is a tax levied by the government on both individuals and businesses taxable income. Businesses usually list this figure on their annual income statement and use it to help determine overall company expenses and profits.

Because you are forming your LLC as spouses you have some options when it comes to your LLC taxes. And that 15 rate is also lower than you would pay if your business was an S Corporation.

Cpa Vs Tax Attorney Top 10 Differences With Infographics

The Difference Between A Tax Cpa And Ea All Your Questions Answered Basics Beyond

Master S Degree In Accounting Salary What Can You Expect

How Much Do Top Footballers Make Salaries Earnings Income Sponsorship Others Radamel Falcao Lionel Messi Falcao

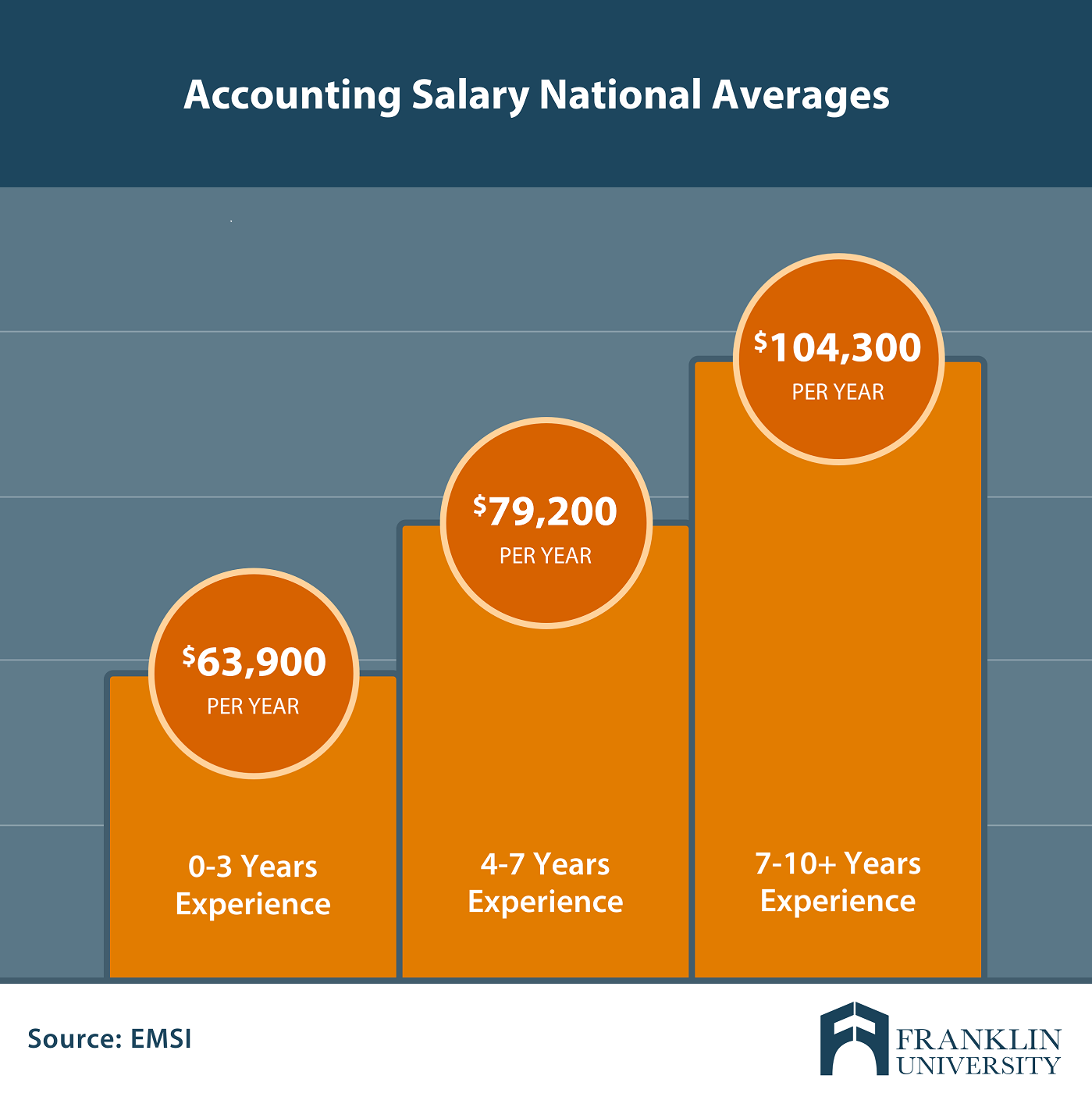

Cpa Salary Guide 2022 Find Out How Much You Ll Make

Cfa Vs Cpa Salary Who Makes More Kaplan Schweser

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Tax Law Salary Northeastern University Online

Pin On Ill Grow Up When I Graduate

Cpa Vs Non Cpa Salary Key Differences Comparisons

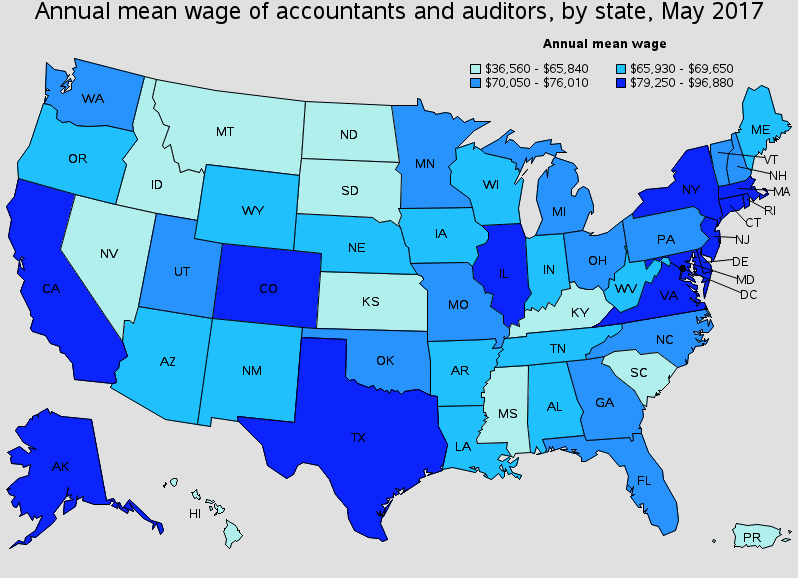

Entry Level Accountant Salary California At Level

![]()

Cpa Salary Guide 2022 Find Out How Much You Ll Make

How Much Money Do Enrolled Agents Make Find Out Ea Accounting Salaries Right Here Enrolledagent Salary Accountingcareer Enrolled Agent Cpa Exam Salary

Average Cpa Salary What Can I Expect To Make Wall Street Oasis

Cpa Vs Lawyer Top 10 Best Differences With Infographics

What Can You Do With An Accounting Degree Accounting Degree Accounting Jobs Accounting

Wage Garnishment Wage Garnishment Tax Help Tax Attorney

Average Certified Public Accountant Cpa Salary Compensation Guide